Tariff and rule announcements impact the supply side of the market

Onthispage

In late September, the U.S. government announced two measures with potential impacts on the North American trucking industry: interim rules on non-domiciled commercial driver’s licenses (CDL) and proposed tariffs on heavy-duty truck imports.

The DOT’s interim final rule, based on a 2025 Department of Transportation (DOT) audit, marks a tightening of non-domiciled CDL issuance, aimed at improving highway safety after compliance failures and multiple fatal crashes. Effective immediately, states must pause issuing these licenses until they meet new standards, which restrict eligibility to specific employment-based visa holders (H-2A, H-2B, E-2) and require annual in-person renewals tied to immigration status verification.

According to DOT’s report, about 194,000 current non-domiciled CDL holders will be affected over the next two years as current license holders apply for renewals. In 2025, only about 6,000 people are working under the employment-based visas listed in the rule. While the impact won’t be immediate, these changes—combined with other enforcement actions—will gradually tighten driver supply, forcing carriers to adapt hiring and compliance strategies.

The rule underscores FMCSA’s focus on security, safety, and accountability, signaling a long-term structural shift in how foreign-national drivers participate in the U.S. trucking market and could add upward pressure on carrier rates over time.

Meanwhile, the U.S. announced a new 25% tariff on heavy-duty truck imports, effective October 1, 2025, adding to the number of complications original equipment manufacturers (OEMs) are navigating. OEMs, actively managing existing tariffs on steel and aluminum, are struggling to calculate the amount of material that will be impacted by those tariffs and have been doing their best to mitigate cost impacts.

Efforts to diversify sourcing have been challenging amid shifting trade policies. Additionally, there is still uncertainty as to whether these new heavy-duty truck tariffs will carry a USMCA exemption and whether there will be changes to the final ruling on the EPA’s 2027 emission standards. This comes as Class 8 truck sales are down 12% year-over-year (y/y) and orders are down 5% due to the struggling freight market.

Dealers have mentioned negotiating with OEMs on who will absorb tariff costs, but with a soft freight market and ample truck supply, OEMs have limited ability to pass costs to buyers. Higher truck and parts costs could lead carriers to delay new purchases, increasing maintenance expenses and eventually raising barriers to entry. Over time, this could reduce capacity and increase operating costs that have already risen at a significant rate over the last five years.

In summary, the short-term impact is likely minimal. However, the combined effect over time of regulatory and enforcement changes, tariffs, and broader market conditions could start to create pressure on the market, possibly in the second half of 2026.

U.S. Spot Market

U.S. spot market forecast: Dry van truckload

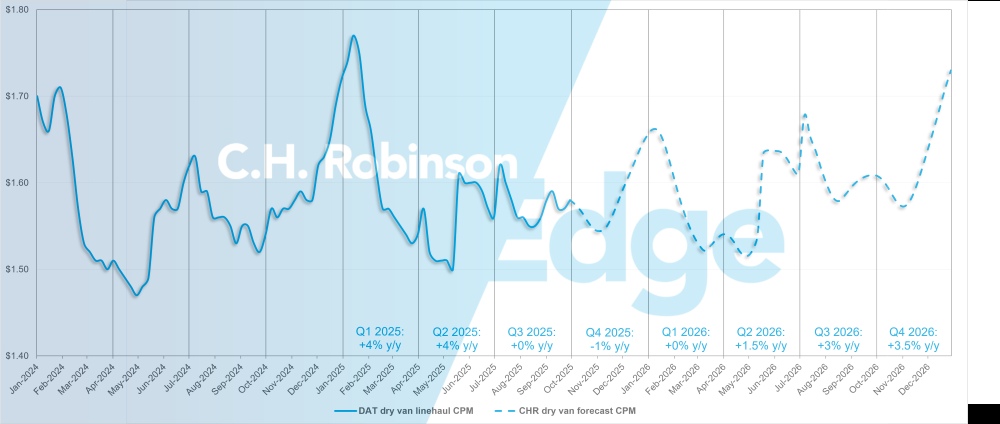

The C.H. Robinson 2025 dry van cost per mile forecast remains at +2% y/y, while the 2026 forecast also remains at +2% y/y. While in “normal” years, the Q4 holiday freight peak is a sharp surge, many retailers report that this year they are observing a more moderate bump rippling through the season. Mid-sized chains are moving toward “on-demand” purchase orders and stocking smaller quantities when needed, which results in a more reactive inventory push rather than a proactive, large-scale buildup.

C.H. Robinson spot market dry van truckload forecast

U.S. spot market forecast: Refrigerated truckload

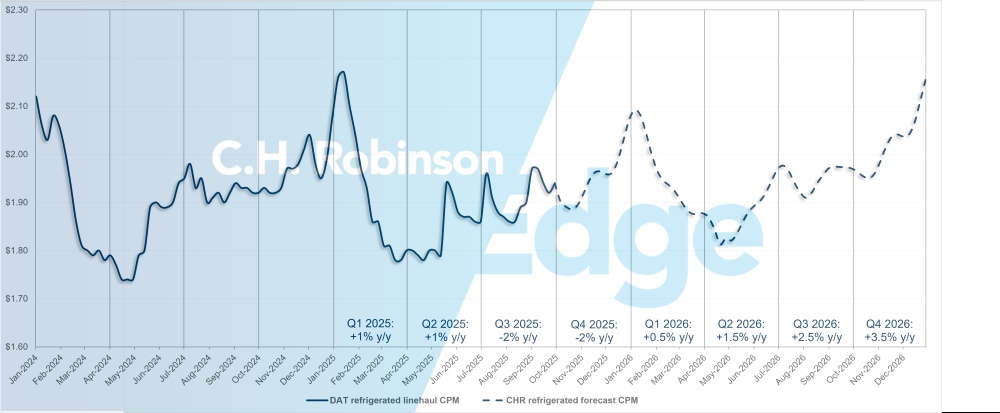

The C.H. Robinson 2025 refrigerated van cost per mile forecast remains at -1% y/y, while the 2026 forecast remains at +2% y/y.

C.H. Robinson spot market refrigerated truckload forecast

For-hire carrier authorities forecast

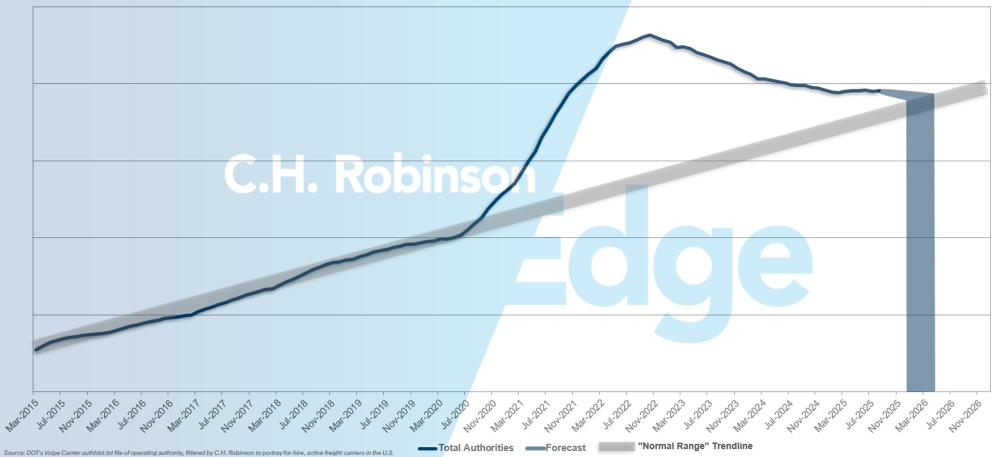

Each month, carriers continue to close due to the challenging freight environment. This has been mostly balanced out by the number of new entrants into the market. The net effect is a slowly decreasing carrier population. If the current pace of U.S. carrier attrition continues, carrier authority counts would return to historical levels in early 2026, possibly later.

For-hire carrier forecast

Contract truckload environment

The following insights are derived from C.H. Robinson Managed Solutions™, which serves a large portfolio of customers across diverse industries.

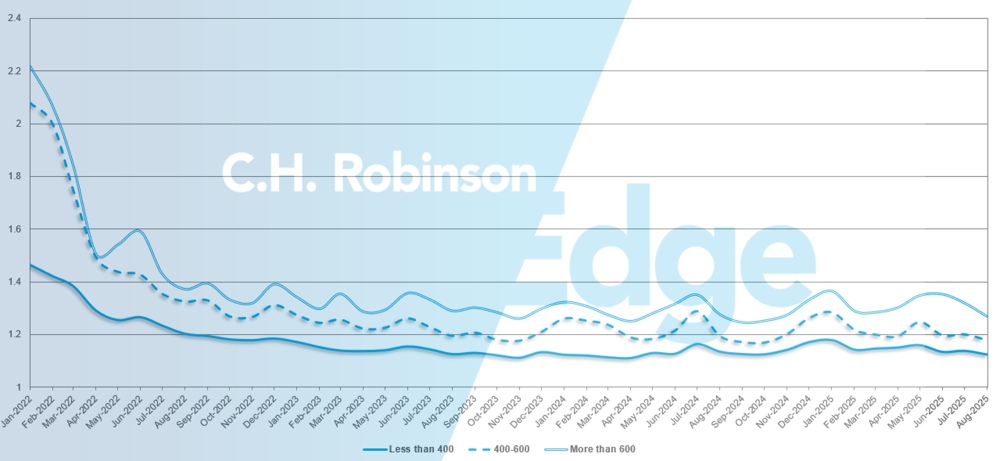

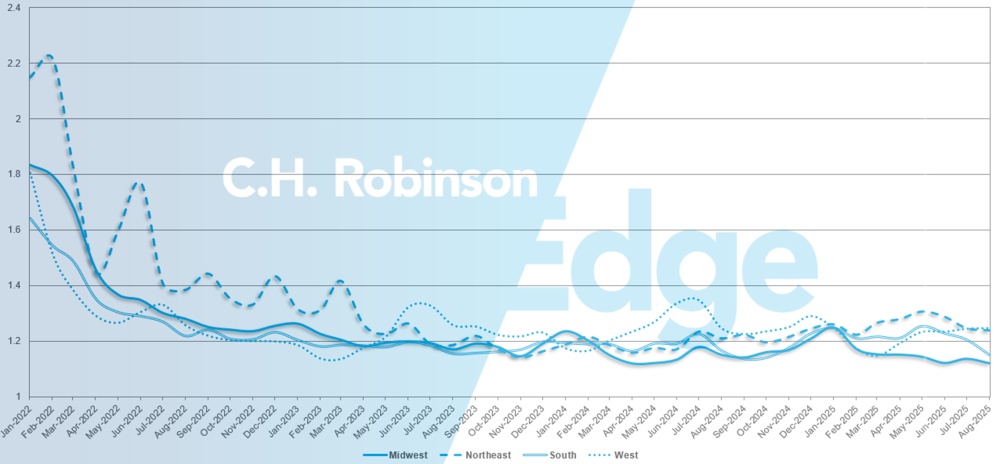

Route guide depth (RGD) is an indicator of how far a shipper needs to go into their backup strategies when awarded transportation providers reject a tender. As displayed in the following chart, the RGD has remained flat at a historically low level for approximately two years.

For the month of August, route guide depth across all North America shipments was 1.18, an improvement compared to the previous month of 1.20.

From a mileage perspective, long hauls of more than 600 miles had a route guide depth of 1.27 in August, which is better compared to the prior month of July 2025, at 1.32, and better compared to August 2024, which was at 1.28. The trend for shorter hauls of less than 400 miles is similar. Route guide depth for August 2025 on these shorter hauls was 1.12, which is slightly better than the previous month of 1.14 and better than August 2024 at 1.13.

North America route guide depth metrics: By length of haul

Geographically, the West experienced the smallest change of all regions, not changing from the previous month, while the South experienced the largest change at -5%. Route guide depth still remains at low levels between 1.12 and 1.25 for all regions.

U.S. route guide depth metrics: By region

Refrigerated truckload

East Coast United States

The Southeast remains one of the softest regions in the country. With ample capacity available, there is little difficulty securing trucks, even on same-day freight. Florida and Georgia in particular continue to see excess capacity, keeping outbound rates subdued. However, the opposite is true for freight heading into these markets. Inbound lanes, especially into Florida, remain relatively expensive and challenging to cover, as carriers are reluctant to commit equipment to such imbalanced markets. Looking ahead, conditions in the Southeast are expected to stay soft and stable through October, providing shippers with favorable buying conditions for outbound moves.

The Northeast tells a different story. While overall capacity has been relatively stable, same-day coverage is becoming more difficult in certain pockets, particularly for freight moving southbound into Florida. Importantly, market signals suggest capacity in the Northeast likely peaked in late September. Rates in October are expected to remain at current elevated levels, which are broadly near the highest seen in 2025 for the region. Shippers moving freight out of the Northeast should plan for persistent pressure through the month, as demand and seasonal dynamics apply pressure.

Central United States

In the northern Midwest, capacity tightened in September, and rates have followed an upward trajectory into October. Michigan has been notably tighter than the rest of the region, while South Dakota continues to see patchy capacity that can make coverage inconsistent. Overall, the northern Midwest is mirroring dynamics seen across the North, with elevated volumes keeping rates at higher levels than earlier in the year. These conditions are expected to persist through October, making this one of the more expensive timeframes for outbound freight in the region.

In contrast, the central and southern Midwest remain more balanced. Illinois is largely experiencing a rate issue rather than true capacity constraint, while Arkansas and Missouri are seeing only slightly inflated rates with trucks still accessible. Further south, Dallas appears to be softening as demand slows, and capacity in southern Texas remains readily available. Overall, the central and southern Midwest are expected to maintain relatively stable conditions into October, offering shippers a more favorable environment compared to the northern states.

West Coast United States

Intra-California freight costs have eased as seasonal produce demand tapers, particularly for berries, with growing regions shifting into their winter cycle. Long-haul lanes out of California are also trending downward, and no major disruptions are expected in the near term. Arizona remains a tighter market, where limited outbound produce and fewer inbound trucks continue to support elevated rates. This pressure is likely to persist through mid-October, with some relief expected once regional produce begins moving again.

In the Pacific Northwest, outbound demand is set to increase as the apple harvest ramps up in early October. Shippers should anticipate higher rates and tighter capacity through the fourth quarter, though stronger volumes may also improve backhaul opportunities into the region.

Looking ahead, the Diwali holiday on October 20 may temporarily impact coverage and costs, as many carriers in the west region observe the celebration with time off from work. It is recommended that shippers plan critical moves in advance to avoid potential service disruptions during that week.

Flatbed truckload

Flatbed market conditions followed a familiar seasonal pattern in September, with load-to-truck ratios climbing moderately as shippers worked to move freight ahead of colder weather. This uptick is typical for the season, particularly in construction and building products, where deliveries and jobsite activity become more challenging once temperatures drop and ground conditions freeze. As winter approaches, shippers should anticipate more frequent delays or rescheduling in weather-sensitive sectors.

Mixed economic signals

The Federal Reserve cut interest rates by a quarter point—a modest move unlikely to drive immediate freight demand but potentially supportive of housing and construction activity if additional cuts follow. Housing starts rose 5.2% month-over-month, though construction spending edged down 0.1%. Manufacturing output was flat from the prior month but 1.4% higher year-over-year.

Flatbed market view

Flatbed spot demand has been gradually easing, with both volumes and rates trending lower for several months. While seasonal surges are still emerging ahead of winter and major project deadlines, the broader trajectory points to a cooling market. Spot rates continue to decline steadily, and demand indices suggest a more subdued environment compared to earlier peaks.

Even so, spot volumes remain higher than a year ago, indicating that while the market is softening, it is not deteriorating. Regional volatility persists, especially where construction projects are being accelerated before weather becomes a constraint. As the construction season winds down, downward pressure on rates is expected to continue, though short-term spikes are still likely in localized pockets.

What should shippers do?Flatbed shippers can best navigate these conditions with proactive planning and flexibility. Extending lead times, remaining adaptable on equipment and scheduling, and closely monitoring regional project activity will help mitigate volatility. Leveraging tools such as a Supply Chain Inspection Report can also provide an edge by highlighting potential risk zones, supporting pricing strategies, and strengthening service performance as the market transitions into the winter months.

Voice of the carrier

Observations from a cross-section of the contract carriers in the C.H. Robinson network:

Market

- Demand remains sluggish, and although freight is available it is at rates that are too low, and carriers are beginning to pass on that freight.

- Operating costs remain high, pressuring profitability even on higher paid freight.

- Networks have been tightened as fleets right-size to the market conditions. This has resulted in a slow rebalancing of the market but the future outlook remains cloudy.

Drivers

- Feedback is mixed: some carriers face hiring challenges in competitive regions, while others report ample driver availability and are being selective.

- Broad agreement that high-quality drivers remain difficult to secure.

- EV carriers report easier recruitment, attributing it to a better driving experience and short-haul routes.

Equipment

- Fleets are holding steady on equipment counts, cycling out older units, but not expanding. Tractor prices remain high, while trailer prices—new and used—have fallen sharply.

- Some carriers are exiting temperature controlled capacity, with significant losses on recent trailer sales.

Download slides

Download slides