Golden Week impacts Asia’s global air freight schedules

Asia

Global trends

The Asia air freight market is showing signs of recovery and stabilization heading into Q4. Demand is gradually increasing across key origins, contributing to moderate week over week rate growth. Be aware that China’s Golden Week in early October may temporarily reduce demand, which could result in schedule adjustments or limited space availability.

At the same time, ongoing diversification of manufacturing to Southeast Asia and strong artificial intelligence-related cargo flows from Taiwan to the United States may shift available capacity toward these markets. Southeast Asia is already seeing higher booking activity and rising demand, particularly from Singapore, Thailand, and Vietnam, suggesting tightening space conditions for shippers across multiple origins.

From mid-October onward, traditional peak season demand is expected to pick up globally. U.S.-bound shipments may experience more moderate growth due to trade tariffs and their impact on consumer sentiment, while European markets are expected to remain stronger.

Regional highlights

Asia to North America

Forecast: Demand will temporarily drop during Golden Week in early October, prompting airlines to rationalize schedules. Recovery is expected from mid-October with traditional peak season patterns, though growth may remain tepid. Rates are expected to rise moderately from the second half of October onward.

Market dynamics: Trade tariffs are affecting U.S. consumer sentiment, which is expected to limit air freight growth to the United States compared to other regions. During China’s Golden Week, airlines often adjust their schedules—through redeployments or cancellations—to manage the temporary drop in demand. Meanwhile, Taiwan continues to see strong demand for artificial intelligence cargo shipments to the United States. At the same time, the ongoing shift of manufacturing to Southeast Asian countries may lead airlines to redirect capacity away from traditional China and India routes. These shifts highlight the importance for shippers to plan early and remain flexible as capacity moves to meet changing demand patterns.

Asia to Europe

Forecast: The air market from China to Europe has recovered since mid-August and is currently stable. Rates are expected to continue climbing through early October, as shippers rush to move cargo before Golden Week shutdowns. European demand is expected to be stronger than U.S. demand during the traditional peak season.

Market dynamics: The market recovery reflects a combination of seasonal demand building ahead of China's Golden Week in early October and sustained growth across cargo types. High-profile product launches, including Apple's new devices, are generating significant charter activity and keeping capacity tight from key origins like China, Vietnam, and India. The Hong Kong to Europe market is particularly strong, with space constraints driving rate increases as shippers compete for available capacity.

Key takeaways

Asian shippers should expect continued rate increases through early October as markets build momentum ahead of China's Golden Week. While space remains available, pre-booking is necessary for larger volumes to ensure capacity. Companies should secure space early given the combination of seasonal demand patterns and high-profile product launches driving charter activity. Southeast Asia shippers from Singapore, Thailand, and Vietnam should prepare for rising demand and tightening capacity as booking requests increase.

Europe

Global trends

The Trans-Atlantic air freight market enters the final quarter of 2025 with modest demand growth and lingering capacity pressures. Passenger belly capacity has largely returned, but freighter supply remains tight due to aircraft delivery delays and fleet retirements.

Trade policy shifts from potential U.S. tariffs and softer consumer sentiment add uncertainty to the usual holiday peak season dynamics, creating planning challenges for European exporters. The Europe to North America eastbound market lacks the typical peak season surge compared to westbound flows, leaving European exporters with weaker seasonal dynamics during what is traditionally the busiest shipping period.

Regional highlights

Europe to North America

Forecast: Air freight rates for Trans-Atlantic westbound lanes should remain steady through October, before increasing in November and December as peak demand builds. Short-term spikes above this range are possible if winter passenger schedule reductions limit available cargo capacity.

Market dynamics: This westbound lane benefits from holiday retail restocking, ecommerce flows, and high-value shipments including pharmaceuticals, automotive parts, and fashion goods. These cargo types drive consistent demand during peak season as holiday inventory cycles intensify. A weaker U.S. holiday season could limit demand growth, while any disruption to freighter availability or winter passenger schedule reductions could create capacity constraints and rate volatility.

Key takeaways

European shippers should secure space early for mid-November through mid-December, as westbound demand from Europe to North America builds during the peak season. In contrast, eastbound flows from North America to Europe are expected to see more stable pricing. Companies should plan for these differing seasonal patterns: Europe to North America shipments typically experience holiday surges, while North America to Europe volumes remain comparatively softer. Additionally, reduced passenger schedules during winter could tighten available capacity in both directions, making early booking especially important for time-sensitive shipments.

North America

Global trends

North American air freight markets enter Q4 with mixed signals as traditional peak season approaches. U.S. consumer sentiment remains softer than previous years, creating uncertainty around holiday air freight demand as well as export volumes to many regions. The potential introduction of new U.S. tariffs is complicating export planning for North American companies, as reduced import volumes could limit the capacity typically available for outbound shipments.

While belly cargo capacity on North American passenger aircraft has largely normalized, supply of dedicated freighter aircraft remains constrained due to delivery delays and fleet retirements, impacting major international routes. The Trans-Atlantic market is shifting to winter schedules to reflect lower travel demand, with reduced flight frequencies further tightening overall capacity.

Regional highlights

North America to Europe

Forecast: Air freight volumes on Trans-Atlantic eastbound (TAEB) lanes should be flat y/y through Q4. Air freight rates are expected to remain stable with some downward pressure, though occasional spikes may occur for time-sensitive spot cargo.

Market dynamics: This eastbound lane primarily handles industrial components, aerospace and automotive parts, and ecommerce return goods—cargo types that follow different seasonal patterns than the consumer-driven westbound shipments. Two key factors could influence capacity and rates on this route. First, reduced passenger flights during the winter may limit available belly cargo space, potentially putting upward pressure on rates. At the same time, weaker industrial demand could offset this effect, keeping rates stable or even causing them to decline, as less cargo competes for the available capacity.

North America to South America

Forecast: Shipments to South America are experiencing shorter delays compared to the summer months. Demand has stabilized across major destinations after a period of softness. Q4 is expected to show seasonal improvements based on historical trends.

Market dynamics: Miami is a key gateway for air freight shipments to South America, making the hub particularly sensitive to seasonal demand fluctuations. In Q4, volumes are expected to increase as ecommerce shipments ramp up in preparation for the holiday season, especially to Colombia, Chile, Peru, and Brazil. While recent performance has been flat compared with last year, historical seasonal trends suggest demand should strengthen through the end of the year.

Key takeaways

North American shippers should secure air freight capacity early for mid-November through mid-December, as peak season demand builds and capacity constraints intensify. Market conditions will vary across lanes, so planning ahead is critical. While a softer U.S. holiday shopping season may help keep rates stable, disruptions in freighter capacity could still create short-term volatility, particularly for time-sensitive shipments.

Trans-Atlantic lanes face additional challenges as airlines transition to reduced winter schedules, gradually lowering available cargo space. Shippers should prioritize early bookings for urgent or high-value shipments to avoid delays or limited options during peak periods.

South American lanes remain highly dynamic, with conditions shifting rapidly as holiday demand ramps up. Proactive planning and early bookings across all destinations can help shippers avoid premium pricing, secure the necessary space, and maintain reliability during this critical period.

South America

Global trends

South American air freight markets are showing signs of stability across key destinations heading into Q4. North America to Central and South America tonnage remained flat year-over-year in August, with a slight 2% decline over the past three months. Based on historical trends, the market is expected to improve seasonally during Q4. Ecommerce shipments are likely to increase as companies prepare for the holiday season, particularly to Brazil, Colombia, Chile, and Peru.

However, new system implementations at Buenos Aires cargo handling facilities are causing processing delays, which are affecting transit times for inbound shipments.

Key takeaways

South America shippers should prepare for seasonal volume increases in Q4, particularly for ecommerce cargo to Colombia, Chile, Peru, and Brazil. Companies shipping to Argentina should factor in additional processing time in Buenos Aires at EZE airport due to processing delays due to the new system rollout. Early booking and flexible timing will help manage capacity pressures as holiday demand builds across the region.

South Asia, Middle East, Africa (SAMA)

Global trends

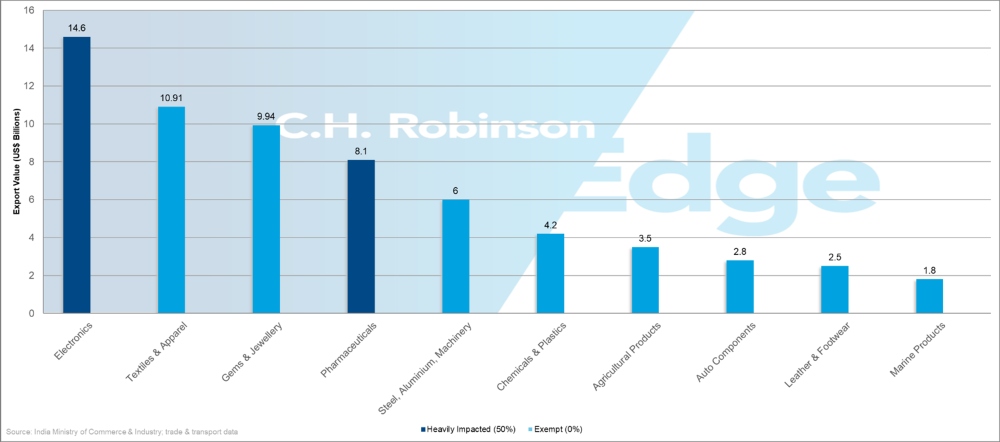

Export values by sector

Source: India Ministry of Commerce & Industry; trade & transport data

SAMA air freight markets face mixed conditions heading into Q4. India is under pressure from recently imposed 50% U.S. trade tariffs, which have reduced cargo volumes to the United States by 12–14% since late August. At the same time, the broader region benefits from global air cargo demand growth of 3.2% year to date. Carriers are currently operating with excess capacity of roughly 20–25% due to weaker U.S. demand, though upcoming winter schedules are expected to tighten supply as fuel costs rise and payload restrictions take effect.

Regional highlights

India to North America

Forecast: Air cargo volumes to the United States are expected to remain depressed following the decline after the U.S. tariff implementation. Alternative markets show growth potential as India diversifies export destinations to Africa, South America, and Southeast Asia to reduce U.S. market dependence.

Market dynamics: U.S. tariffs of 50% on Indian goods are severely impacting readymade garments, auto components, and gems and jewelry. Major airports like Delhi and Bengaluru are continuing to evolve into global hubs, expanding freighter fleets and adopting AI, IoT, and blockchain technologies.

Key takeaways

Exporters should consider leveraging the current excess capacity conditions and competitive rates while diversifying away from U.S. markets. The electronics, and renewable energy equipment sectors remain largely unaffected by tariffs and offer stable air freight opportunities. Shippers should prepare for winter schedule capacity reductions due to operational constraints, while taking advantage of strong demand growth on Europe–Asia and intra-Asia lanes that benefit from global trade pattern shifts.

Oceania

Global trends

Oceania air freight markets are showing mixed conditions heading into Q4. Overall cargo demand has softened compared with 2024, but seasonal volumes—particularly for Asia-bound shipments—are expected to remain above normal levels. At the same time, ongoing freighter service disruptions and slower ocean transit times is shifting cargo from ocean to air, adding pressure on available capacity.

Brown Marmorated Stink Bug (BMSB) season restrictions are increasing demand for air freight, as shippers look for alternatives to meet shipping deadlines. This added demand is keeping cargo-only flight rates above typical levels. Additionally, the start of the stone fruit season in Q4 will occupy more space on passenger aircraft, further reducing available cargo capacity for other export commodities.

Regional highlights

Oceania to Asia

Forecast: Volumes are expected to be slightly higher than normal for seasonal cargo, including retail, perishables, and electronics. Pricing pressure will continue due to capacity constraints and conversion from ocean freight.

Market dynamics: Ongoing freighter service disruptions and slower ocean transit times are leading shippers to move cargo from ocean to air freight to meet delivery deadlines. At the same time, BMSB season requires shipments to undergo fumigation treatments, which adds time and complexity to ocean shipments and further increases reliance on air services. The combination of these factors—ocean delays and higher air freight demand from cargo conversions—is creating tighter capacity, resulting in cargo-only flight rates that are remaining above typical levels.

Key takeaways

Shippers should anticipate ongoing capacity pressures and elevated rates due to freighter service disruptions and cargo shifting from ocean to air. Companies handling seasonal shipments bound for Asia—particularly retail, perishables, and electronics—should secure bookings early. The start of stone fruit season will occupy significant belly capacity on passenger aircraft, making early planning essential for non-agricultural exports throughout Q4.

Download slides

Download slides