Carriers cut capacity as demand surge fades

Published: Thursday, August 07, 2025 | 06:00 AM CDT

Onthispage

Ocean freight markets are undergoing a significant correction. Carriers are removing capacity in response to weaker demand following changes to U.S. reciprocal tariffs that were announced August 1 and went into effect August 7, 2025.

Carriers had positioned additional vessels expecting sustained cargo surges as importers rushed to avoid higher tariffs. Much of this frontloading happened in March and April, leaving carriers with excess capacity and insufficient bookings as a second import surge into the U.S. market in June and July was not as strong as anticipated.

Effective August 1, 2025, Mediterranean Shipping Company (MSC) withdrew its Pearl service, marking the first major service string cancellation. Additional ad-hoc blank sailings are expected across multiple trade lanes as booking levels continue falling short of carrier projections, creating tighter space availability for shippers even as overall U.S. import demand softens.

The situation is complicated by ongoing structural constraints: Diversions away from the Suez Canal continue taking up 15%–20% of global vessel capacity, while widespread port congestion across Europe, Asia, and Latin America further limits effective capacity utilization. These factors mean that even with reduced U.S. import volumes, export cargo faces persistent space shortages and rate pressure.

For shippers, this environment creates a mixed outlook:

- U.S. import cargo benefits from improved pricing as carriers compete for limited volumes.

- U.S. export cargo faces tighter space availability and more frequent general rate increases (GRIs) as carriers attempt to maintain profitability with fewer ships in service. The capacity removed from import trades doesn't automatically transfer to export routes, creating bottlenecks.

Ocean reliability rises, setting the stage for a more predictable peak season

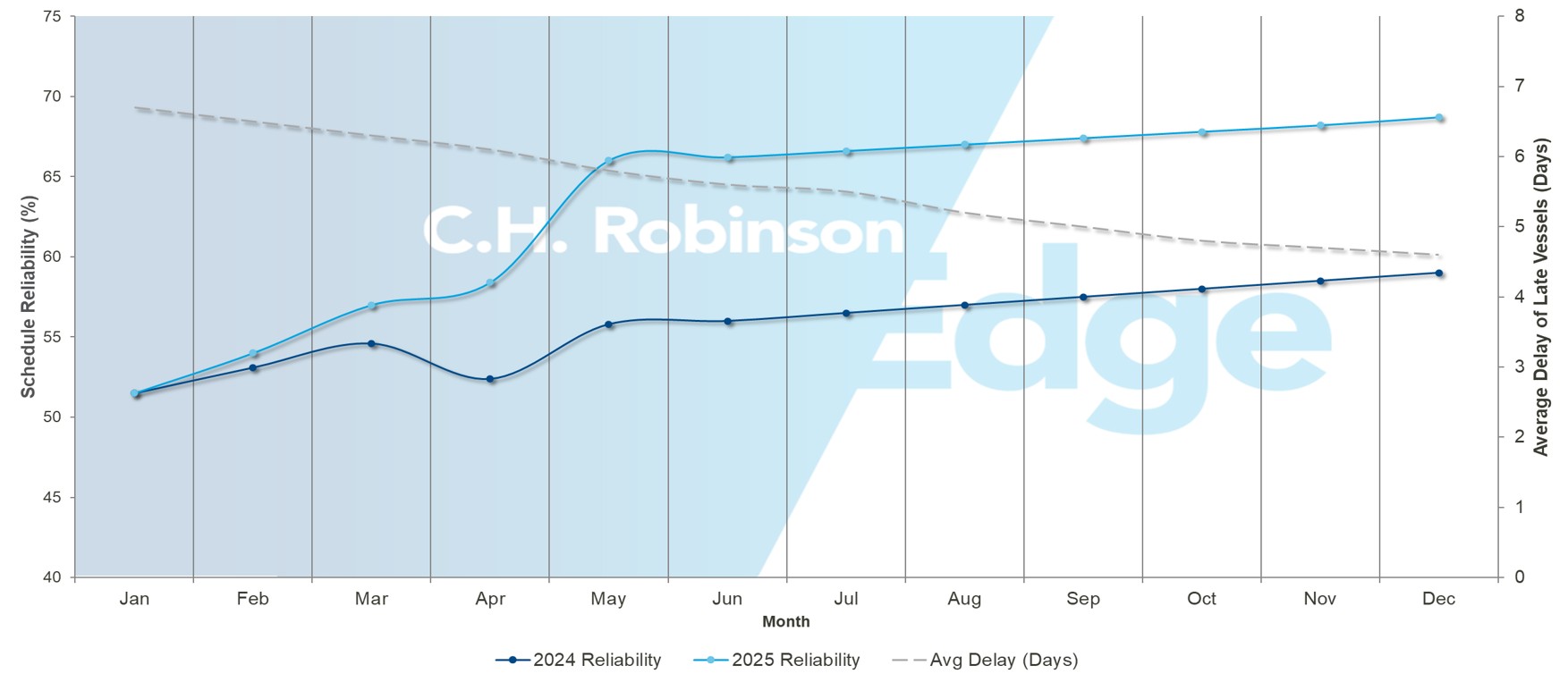

Global ocean performance: Reliability vs. delay

Source: Sea-Intelligence

Global ocean carriers have achieved meaningful progress in schedule consistency, with June data (the latest available) showing global schedule reliability climbing to 67.4%, the highest reading since late 2023. The average delay for late vessels also eased to 4.5 days, which is the best performance in nearly two years.

Regionally, the momentum is unmistakable. Asia–North America West Coast services clocked 78% reliability, a five-point lift in a single month. Asia–North America East Coast lanes jumped to 71.2%, while South America–North America surged 14 points to 81.3%, leading all trade lanes in month over month gains. Even traditionally volatile routes like Asia–Mediterranean are inching upward, suggesting a broader stabilizing trend.

For shippers, this isn't just a rearview snapshot—it's a forward-leaning signal. Five consecutive months of reliability gains and shrinking delay windows indicate peak season planning may shift from reactive crisis management to proactive strategic planning. Carriers are still fine-tuning schedules and isolated lane volatility will remain, but the data points to a second half of 2025 where service predictability becomes a competitive advantage rather than a persistent challenge.

Asia

Asia–U.S.

China volumes dropped 27% year-over-year (y/y) in June, while Southeast Asia surged 33%, demonstrating the ongoing supply chain diversification away from China. The net effect is a headwind for carriers. Total Asia volumes are down despite Southeast Asian gains, creating capacity-demand imbalances.

Trans-Pacific spot rates have continued sliding downward, particularly on the U.S. West Coast (USWC) corridor, with this decline spreading to U.S. East Coast (USEC) services as well. The initial rate differential between these corridors has largely diminished as carriers compete for available cargo in both markets.

Carriers announced rate increases effective August 1, but the proposed hikes were ultimately not implemented. After the inventory-building ahead of the August 7 U.S. reciprocal tariff changes, demand is expected to be less than the capacity carriers had positioned.

MSC's withdrawal of the Pearl service represents the first major capacity reduction, but additional blank sailings are expected as carriers continue removing capacity through ad-hoc schedule adjustments. Rate fluctuations will persist throughout August, with disparities likely between small and large carriers as they compete for limited cargo volumes.

Current market conditions favor shippers, creating opportunities to ship non-urgent cargo at favorable rates. Shippers should monitor market developments closely and leverage this buyer's market environment while it persists, as capacity cuts will eventually tighten conditions.

Asia–Europe

The Asia-North Europe trade lane demonstrates markedly different dynamics from Trans-Pacific routes. This lane has remained resilient, with rate increases implemented in July extending into August.

Persistent congestion at major north European ports—including Rotterdam, Hamburg, and Antwerp—continues constraining capacity by extending vessel turnaround times and reducing effective service frequency. Here's how it works: Instead of a typical two-or-three-day port stay, vessels are now spending longer due to berth delays and slower cargo handling.

This means a ship that normally completes 12 round trips per year can now complete only eight or nine trips, reducing the total shipping capacity available to the market by roughly 25%–30%. With fewer sailings available, but similar amounts of cargo needing transport, shippers must compete for the limited space. This is driving rates higher, regardless of whether overall trade volumes are growing or declining.

Ocean Alliance carriers plan to remove 15% of capacity in August, further supporting rate stability on Asia–North Europe services. The combination of port congestion and planned capacity reductions creates an environment for spot rates to remain firm throughout the month.

Asia–Mediterranean routes present a contrasting situation, with spot rates continuing to slide during European summer holidays. In response to accelerating rate erosion, Ocean Alliance carriers have planned approximately 25% capacity reductions in August to restore market balance.

The overall outlook for Asia–Europe lanes suggests more stable rates and space utilization in August due to controlled capacity management. However, this stability comes at the cost of reduced space availability, requiring shippers to secure bookings well in advance.

Shippers on Asia–Europe routes should continue booking space three to four weeks ahead, as August capacity is expected to remain tight despite demand softening in some segments. The combination of port congestion and deliberate capacity cuts favors advance planning over spot market strategies.

North America

U.S.–Asia

Export markets face a severe shortage of empty containers as reduced Asia–U.S. import volumes limit availability for outbound cargo. This imbalance is particularly acute at U.S. Gulf Coast (USGC) ports and inland rail ramps, where traditional container cycling patterns have been fundamentally disrupted.

Agricultural and manufacturing exporters report extended detention periods and increased repositioning costs as they compete for limited equipment. Carriers continue prioritizing containers for profitable Asia-bound rotations rather than accommodating U.S. export demand, creating persistent shortages that will extend until import volumes recover.

For U.S. exporters shipping to smaller Asia destinations, congestion at major transshipment hubs is translating into longer delivery times and unreliable sailing schedules, even though total cargo volumes moving through these ports have actually decreased. Singapore is operating at 90% terminal capacity, while widespread bottlenecks affect China's major ports and Malaysia's Port Klang.

U.S.–Europe

Export capacity to Europe remains critically constrained. The USGC has only three regular weekly sailings to Europe, creating insufficient capacity to meet export demand.

Several factors are simultaneously worsening the capacity crunch. The Gemini Cooperation's U.S.-flag service reserves substantial space for government shipments, reducing availability for commercial exporters. At the same time, petrochemical resin exports have reached record levels, consuming more container space than usual. European port congestion adds another layer of constraint by slowing vessel turnarounds and reducing effective service frequency.

Houston's traditionally export-oriented market dynamics mean export demand consistently exceeds import levels, creating an ongoing supply/demand imbalance.

North European delays are expected to persist through August as infrastructure constraints worsen. Antwerp and Rotterdam remain the most affected terminals, and some European facilities are at full capacity. Intermittent labor strikes compound network-wide delays.

This means export rates and space constraints are also expected to persist, regardless of Trans-Pacific import market conditions. Expect to book three to four weeks in advance, with USGC origins facing the most severe limitations.

U.S.–South America

Port congestion at transshipment hubs is mixed, with some facilities improving while others continue to face significant operational challenges. Direct shipping services have demonstrated better schedule reliability, though indirect services remain impacted by cascading delays from congested transshipment ports.

U.S.–South Asia, Middle East, Africa

Service options remain severely limited due to geopolitical tensions. COSCO, Hapag-Lloyd, Hyundai Merchant Marine (HMM), and Ocean Network Express (ONE) have suspended Pakistan services due to India-Pakistan conflicts and routing complexities.

MSC maintains the only direct Pakistan service from the USEC, while other cargo must route through Middle Eastern transshipment hubs, adding three to seven days and substantial costs. Orient Overseas Container Line (OOCL) is beginning limited Middle East service, providing a third option alongside MSC and CMA CGM, but capacity remains inadequate for demand.

The practical impact is higher rates, extended booking lead times, and reduced service reliability for cargo to this region. Shippers should consider alternative routing options and build additional transit time into delivery schedules to accommodate transshipment requirements.

U.S.–Oceania

Current demand remains soft on this trade route, with ample space availability on direct services. CMA CGM's service reliability has been impacted by ongoing congestion at European ports, creating a disadvantage compared to direct services offered by MSC and Hapag-Lloyd. Meanwhile, indirect services continue to be disrupted by congestion at Asian transshipment ports. The trade route's peak season is expected to commence this month, which may tighten capacity.

Canada

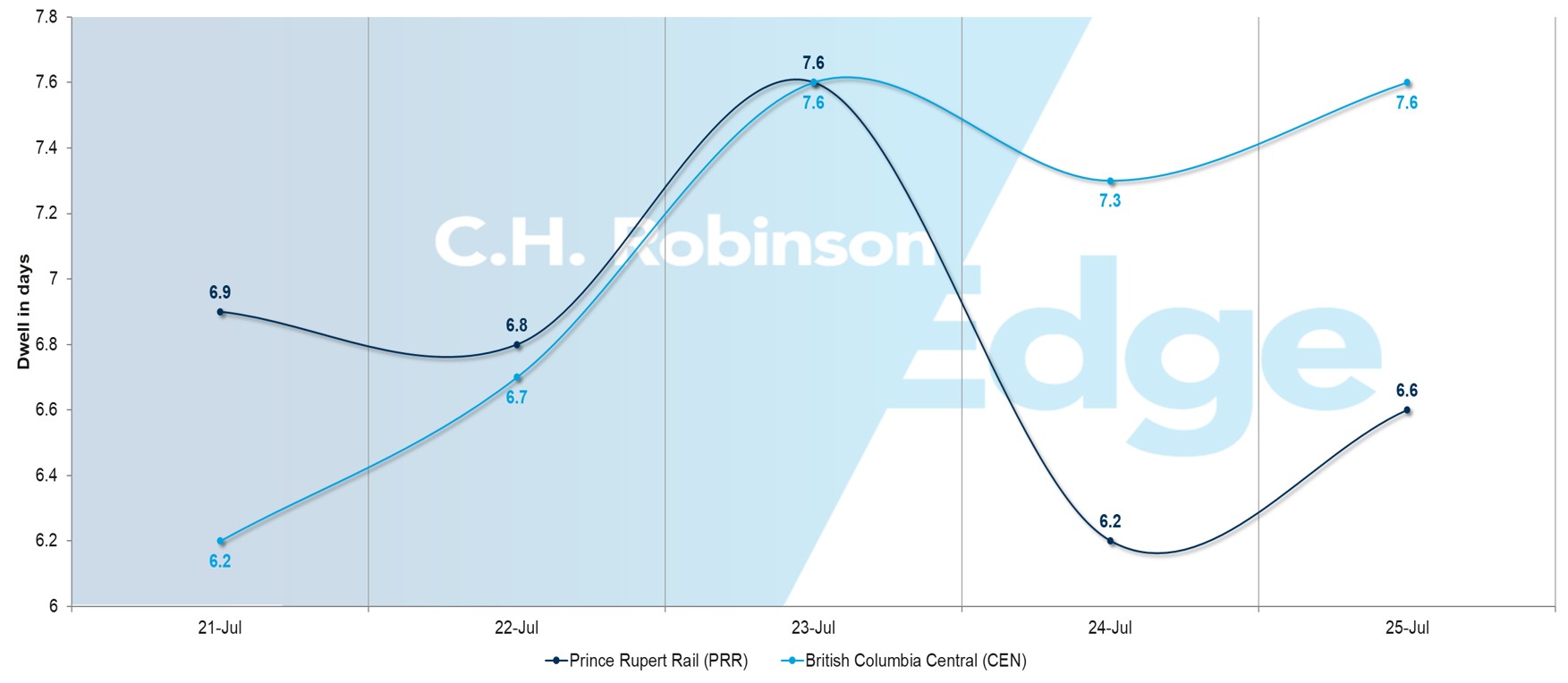

Operational performance varies significantly by terminal

Average dwell time > 5 days

Container dwell times across Canadian gateways show major differences that will affect August delivery schedules.

Best performing terminals for fastest cargo flow:

- Toronto: one to two days

- Halifax Fairview Cove: 1.7 days, an improving trend

Moderate performance requiring additional planning time:

- Montreal: three to four days

- Saint John, New Brunswick: four to five days

- Prince Rupert (PRR): Six days, a significant improvement from 16

Terminals requiring extended planning buffers:

- Halifax Atlantic Hub: 5.5 days, a worsening trend

- British Columbia Central (CEN): eight days

Shippers should consider prioritizing Toronto and Halifax Fairview Cove for time-sensitive cargo. Consider adding one to two weeks buffer time for cargo moving through slower terminals. Emergency Rail Service remains available for urgent British Columbia shipments.

Wildfire season creates potential service risks

Canada’s wildfire season has officially begun, creating potential air quality and transportation disruptions through September.

Monitor weather alerts and consider back-up routing options, particularly for cargo needing interior rail connections. Port operations may face temporary slowdowns during severe air quality events.

August outlook favors Canadian gateways

With labor stability secured and overall port congestion improving, Canadian routes offer increased reliability compared to many U.S. alternatives facing ongoing operational challenges. Terminal selection will be an important factor for optimal service.

Europe

Stronger Europe reliability meets a wave of congestion

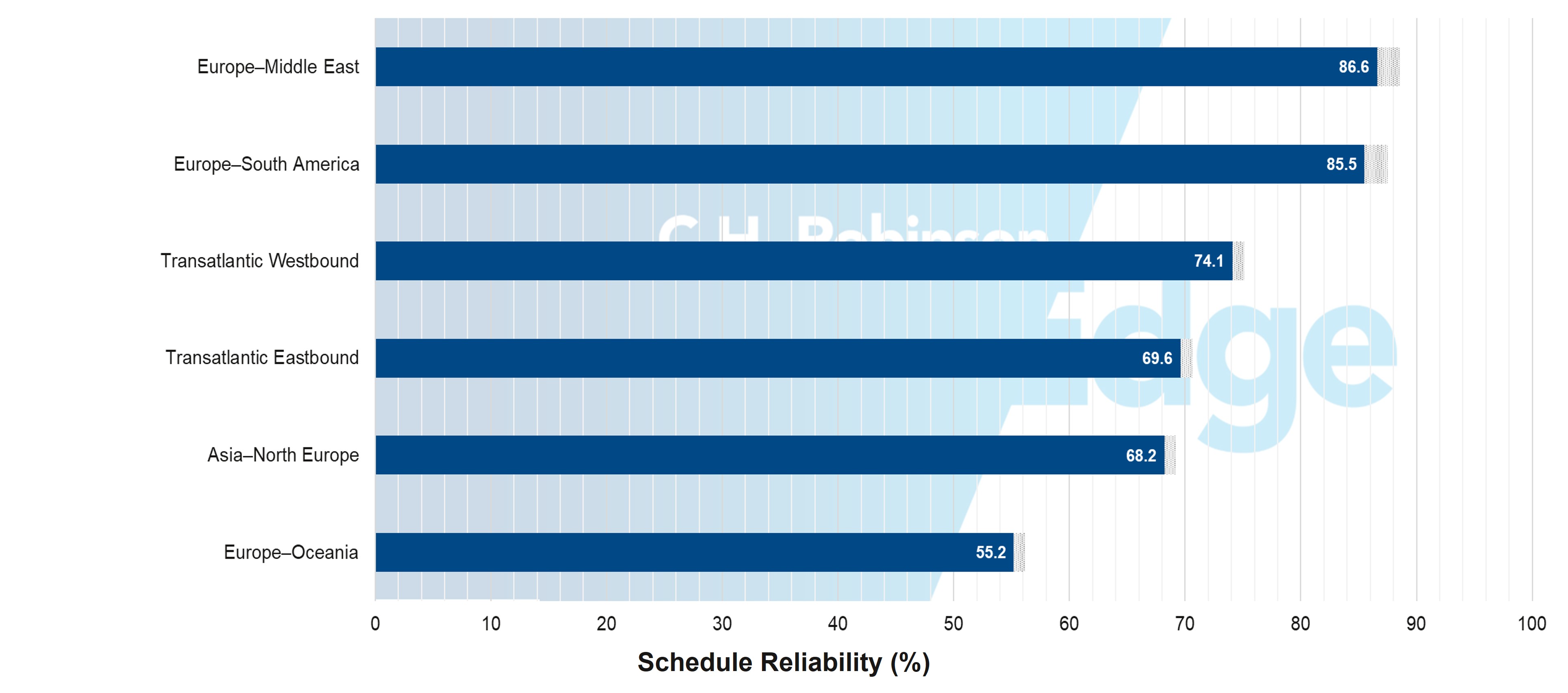

Europe schedule reliability: Current & projected

Source: Sea-Intelligence

Ocean trade lanes tied to Europe are emerging as a bright spot in global reliability trends, but not without friction. June's data (the latest available) shows Europe–Middle East services at 86.6% reliability and Europe–South America close behind at 85.5%, both well above the global average. Even traditionally erratic corridors like Asia–North Europe (68.2%) and the Trans-Atlantic lanes (69–74%) are charting steady improvements—a signal that carrier networks are stabilizing.

Yet Europe is also a current hot spot for port congestion, with yard density climbing in hubs like Rotterdam, Hamburg, and Antwerp. This means vessels are arriving on time more often, but berthing delays and cargo handling bottlenecks threaten to offset these schedule improvements.

This creates a complex operating environment for shippers. Shorter average delays suggest tighter transit windows are finally feasible again, but contingency buffers shouldn't disappear entirely. As carriers refine schedules and ports work through summer backlogs, the back half of 2025 will likely see Europe’s trade lanes leading the return to predictability—provided congestion pressure is managed before peak season fully hits.

Rate dynamics show carrier differentiation

European carriers announced rate increases effective July 1, 2025, but market acceptance has varied significantly. Carriers offering premium service levels have successfully maintained their rate increases, while those providing basic service have faced more pushback, reflecting shippers’ growing willingness to pay for reliable performance.

Unlike Trans-Pacific trade lanes, European routes haven't experienced the same demand collapse following new U.S. tariff implementations. In fact, they have maintained more stable demand patterns, allowing carriers with strong service records to secure rate increases based on their operational performance.

However, demand normalization is expected through August as elevated inventory gets absorbed into supply chains. Rate pressure will intensify as carriers compete for regular volumes, particularly as capacity adjustments follow continued demand softening.

South Asia, Middle East, Africa

50% tariffs on goods from India may affect market dynamics

U.S. importers were already delaying orders from India due to a 25% U.S. tariff that went into effect August 7. Now with an additional 25% tariff scheduled to begin August 27, 2025, more companies may consider postponing or cancelling imports.

Reduced demand for India-to-U.S. ocean freight could result in

- More capacity at least temporarily: Ships would have more containers available unless or until ocean carriers reduce their schedules to match demand.

- Lower shipping rates: Ocean carriers may reduce prices to compete for the remaining cargo, as they'd typically rather carry cargo at lower rates than sail empty.

South America

U.S. tariffs on Brazilian goods trigger immediate shipping cancellations

Brazilian markets have been disrupted by the August 7, 2025, implementation of 50% U.S. import tariffs on Brazilian products. The measure has prompted U.S. importers to cancel or postpone shipments across the agri-food, steel, coffee, citrus, and aerospace sectors. This sudden demand collapse has created booking uncertainty across multiple trade lanes.

Brazil's preparation of retaliatory measures, combined with Venezuela's implementation of tariffs up to 77% on Brazilian imports, compounds regional trade disruptions. Import volumes to Brazil are also affected as buyers adopt cautious approaches or seek alternative sourcing.

Panama Canal zone creates regional bottlenecks

Panama's main ports are experiencing congestion, significantly impacting cargo moving through the canal zone. This affects not only shipments destined for Panama and the Caribbean, but also creates delays for Asian cargo bound for USEC and South America, which rely on Panama as a key transshipment hub.

To avoid these delays, MSC has shifted operations to the inland Rodman terminal, requiring additional truck transport. Other carriers are working within the longer processing times and extended vessel scheduling windows.

Refrigerated surge squeezes Chilean dry cargo space

Chilean operations are experiencing significant challenges as refrigerated cargo volumes increase, resulting in limited space for dry cargo through the end of August. Shippers are strongly advised to share forecasts and booking plans at least four weeks in advance to secure space allocations.

Southern Chilean ports including Lirquén, Coronel, and San Vicente remain particularly challenging due to limited carrier space availability and high demand from commodity exporters, especially wood and oats. Cargo routing through transshipment points in Central America and Colombia's Cartagena port faces delays due to ongoing congestion, extending delivery times to U.S. East Coast destinations.

Callao faces 40-foot container shortage during fishmeal season

The Port of Callao, Peru’s main gateway, is expected to face a shortage of 40-foot containers during Q3 2025 due to increased demand during the fishmeal season. Large-volume shipments should be booked at least three weeks in advance, with volume forecasts shared proactively with carriers. Port access has been slowed by construction projects that are creating truck delays at terminal gates.

Asia-Mexico delays ripple through South American schedules

Services connecting Asia and Mexico's West Coast are experiencing schedule instability due to congestion at Manzanillo, Mexico, and adverse weather conditions in Asia. Many South American shippers are impacted because shipping services often operate on integrated routes. When a vessel is delayed picking up cargo in Asia or discharging in Mexico, it arrives late to South American ports, disrupting the entire regional schedule and reducing available sailing options for exporters.

Buenaventura reliability drops as Cartagena improves

Colombian ports are showing mixed levels of operational performance. Buenaventura has experienced declining schedule reliability in recent weeks due to operational bottlenecks and aging infrastructure. Meanwhile, Cartagena has shown operational improvements, positioning it as a more reliable option for shipments to U.S. destinations and Mexico, though congestion still occurs periodically.

Download slides

Download slides