U.S. trade policy has reshaped import relationships

Published: Thursday, August 07, 2025 | 06:00 AM CDT

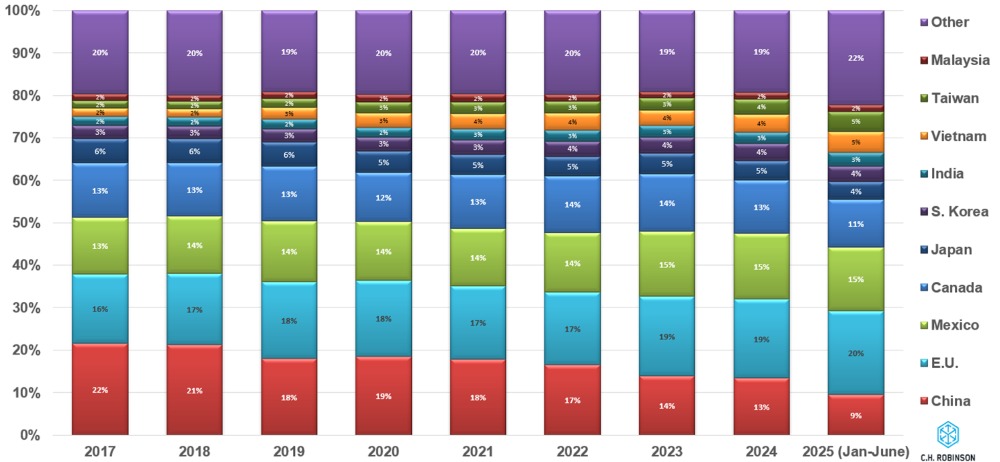

Over the past several years, U.S. import patterns have undergone a significant realignment, reflecting a deliberate shift in trade policy and economic strategy. As seen in the chart below, China’s share of total U.S. imports has declined sharply, falling from 22% in 2017 to just 9% in the first six months of 2025. In contrast, Mexico and the European Union have steadily gained ground. Mexico now accounts for 15% of U.S. imports, the largest share by a single country.

This shift is no accident. Under both the Trump and Biden administrations, U.S. trade policy has increasingly focused on reducing dependency on China, citing national security concerns, supply chain resilience, and unfair trade practices.

This strategy is visible in the rising shares of imports from Vietnam, India, and Mexico, all of which have benefited from companies seeking alternatives to China. Additionally, tariffs on strategic sectors, enforcement of the Uyghur Forced Labor Prevention Act, and the removal of de minimis exemption for Chinese goods have all contributed to these trends.

With ongoing geopolitical tensions and continued tariff and trade barrier conversations, expect the United States to further deepen ties with allies and regional partners. While each supply chain is unique, retailers, manufacturers, and other shippers are increasingly aligning their strategies with the growing likelihood that elevated tariffs will persist.

U.S. import partners: Percent of total

For an overview of recent U.S. tariff changes, see the Trade Policy & Customs section of this report. For details on how new tariffs and the new U.S. federal budget are affecting specific industries, see our Retail Insights, Automotive Insights, and Energy Insights.

Download slides

Download slides