Q4 outlook: Prepare for blank sailings across Asia

Onthispage

Asia

Global trends

Ocean freight markets in Asia face capacity adjustments in October due to China's Golden Week holiday. Golden Week will reduce available capacity through planned blank sailings, while rate trends continue showing downward pressure as demand remains softer than expected. Market conditions are expected to normalise in the second half of October as manufacturing activity resumes. New USTR service fees on Chinese-operated vessels take effect mid-October, though will not affect delivering costs as carriers have committed to absorbing the additional fees rather than passing them to customers.

Regional highlights

Asia to North America

Forecast: October volumes will be slow during the first half of the month due to Golden Week. The demand rebound in the second half of October may be limited given current tariff levels. Rates should remain stable at current levels, with downward pressure continuing to keep pricing low throughout the month.

Market dynamics: U.S. West Coast (USWC) capacity is projected to decrease approximately 10% versus September, while U.S. East Coast (USEC) capacity shows a 14% decline, with the lowest capacity occurring in the second week of October on both coasts. The USTR 301 service fees beginning 14 October will affect carriers differently. COSCO faces the highest exposure, while most non-Chinese carriers remain exempt. Despite this regulatory change, all major carriers have committed to maintaining current capacity levels without imposing additional fees on shippers.

Asia to Europe

Forecast: Rates to north Europe continue to trend downward. Asia to Mediterranean rates are also declining, though more gradually. Most carriers have extended current rates through mid-October.

Market dynamics: The rate difference between north Europe and the Mediterranean reflects varying demand strength. Mediterranean lanes experience more stable demand, which is why rates are declining more gradually in this market. Carriers are keeping their current rate levels unchanged through mid-October, giving shippers predictable pricing during Golden Week. Planned blank sailings during the holiday period aim to balance capacity with current demand levels.

Asia to South America

Forecast: Rates should remain stable in the first half of October, with potential for increases as manufacturing activity resumes in the second half.

Market dynamics: Carriers typically implement blank sailings during Golden Week to manage reduced factory output and delivering activity in China. Recovery in the second half of October reflects resumed manufacturing and inventory restocking cycles that create stronger cargo flows from Asian origins to South American markets. This should help to maintain stable pricing as market activity returns to normal levels.

Key takeaways

Expect slower cargo movement in Asia during the first half of October due to Golden Week, with conditions improving mid-October as manufacturing resumes. Consider securing bookings early for the second half of October as capacity will be limited following the holiday period. Trans-Pacific lanes will face continued capacity constraints and potential delays during the adjustment period. Rate trends continue showing downward pressure across major trade lanes, with the most stable pricing conditions expected to Europe compared to other destinations.

North America

Global trends

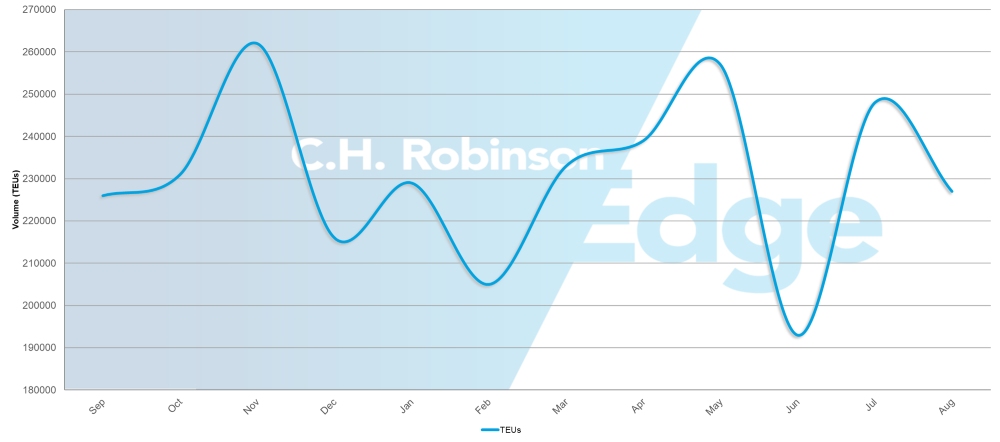

U.S. container import volumes (TEUs)

North American ocean freight markets face mixed conditions heading into the fourth quarter. While U.S. import volumes did decrease 3.9% month over month (m/m), imports showed unexpected resilience in August, rising 1.6% year over year (y/y). However, declines are projected through December, ranging from 6.8% to 20.1% compared to 2024.

Equipment shortages are becoming more prevalent for North American export operations, while global schedule reliability has improved 65.2% for July 2025. U.S. export markets face capacity constraints, particularly from the U.S. Gulf Coast (USGC) region. Consumer spending remained robust in August, supported by stable employment, lower fuel costs and pre-tariff purchasing behaviour, though consumers are becoming more selective in their spending patterns.

New USTR service fees on Chinese-operated vessels begin mid-October, but delivering costs will remain unchanged as carriers are absorbing these charges.

Canadian ports show overall congestion improvements, though Montreal faces low water levels due to a dry summer, with carriers implementing low water service fees. Recent labour arbitration will provide rail operational stability through 2026-2027.

Regional highlights

North America to Asia

Forecast: Capacity will tighten as carriers introduce blank sailings. Southeast Asia lanes will face continued strain from congestion and feeder capacity limitations.

Market dynamics: Weakening demand on Trans-Pacific eastbound lanes is prompting carriers to implement capacity adjustments through blank sailings to keep vessels adequately filled. Because these vessels operate in a round-trip cycle, cancelling an eastbound sailing also cancels its corresponding westbound return. As a result, even though the trigger is weaker U.S.-bound imports, the impact is fewer sailings available for U.S. exporters delivering to Asia.

Southeast Asia faces congestion at key transshipment hubs and limited space on second leg feeders, constraining overall capacity. Gemini's hub and spoke operational model is contributing to increased congestion at transshipment ports, affecting reliability of all services routeing through these critical connection points.

North America to Europe

Forecast: Capacity will remain tight through Q4, with USGC facing the most severe constraints. European port congestion will continue to disrupt service reliability.

Market dynamics: Multiple capacity pressures are converging to create tight market conditions. The Suez Canal closure continues to remove 15-20% of global vessel capacity, while Mediterranean Delivery Company’s (MSC) removal of a USEC service in mid-August has further reduced available options. These capacity constraints are most pronounced on USGC routes, where high export demand significantly outpaces available space. European port congestion continues to disrupt service schedules and port calls, with impacts expected to persist for the next few months.

North America to Middle East/Indian Sub-Continent (ISC)

Forecast: Space availability to India has improved, while Pakistan and Bangladesh remain constrained. Rates will remain elevated until the Suez Canal reopens.

Market dynamics: The Suez Canal closure continues to disrupt normal delivery routes to Middle East and ISC markets. Carriers must use longer alternative routes that reduce available capacity and keep rates high. Capacity conditions vary significantly across ISC markets. Space availability has improved in India, while constraints persist in Pakistan and Bangladesh. Most carriers have resumed Pakistan service through transshipment connections, though MSC continues to offer the only direct routeing from USEC.

North America to Africa

Forecast: Service restructuring will provide more options without significantly increasing overall capacity.

Market dynamics: MSC is launching an independent service to Africa, separating from its current arrangement with Maersk. This creates additional scheduling options while representing a restructuring of existing capacity rather than net additions to the market.

North America to South America

Forecast: Services to Brazil have improved, though significant delays will continue throughout the region due to transshipment port congestion.

Market dynamics: Ongoing congestion at key transshipment ports, including Manzanillo, Mexico and Cartagena, Colombia, is creating cascading delays that affect transit times and schedule reliability across the South America region. These major ports serve as critical connection points for cargo moving between different delivery services, so delays at these facilities create ripple effects throughout the network. While Brazil has seen direct service improvements that bypass these congested transshipment points, cargo routed through the regional hub system continues to face bottlenecks that impact overall performance for deliveries to and from other South American destinations.

North America to Oceania

Forecast: Capacity constraints will persist until February 2026 when new services become available.

Market dynamics: Capacity constraints persist due to the limited number of dedicated services to Oceania. MSC's planned stand-alone service launch in February 2026 will provide the capacity needed for this lane, moving away from shared service arrangements where vessels serve multiple routes and space allocation is divided between different lanes.

Key takeaways

North American importers should prepare for volume volatility through Q4, with the strongest impacts expected in November and December. The implementation of USTR service fees on Chinese-operated vessels beginning 14 October will not affect delivering costs as carriers are absorbing these charges.

Export capacity constraints require earlier planning and booking lead times. Premium service options will be available at higher costs when standard capacity is unavailable. Equipment monitoring is essential as trade volumes shift to mitigate against shortages and service disruptions.

Exporters to Europe will benefit from stable Trans-Atlantic conditions and improving port congestion at destination. Shippers to South America should account for transshipment port delays in key Mexican and Colombian gateways when planning delivery timing. Exporters to Middle East and ISC markets should leverage improved space availability to India while planning alternative routeing strategies for Pakistan and Bangladesh destinations.

Europe

Global trends

Ocean freight markets in Europe enter Q4 with stable demand conditions but face significant policy and operational challenges. New U.S. tariff implementations are reshaping Trans-Atlantic trade dynamics, with a general 15% tariff on European goods including pharmaceuticals and automotive products and 50% tariffs continuing on steel and aluminium. U.S. import cargo volume is expected to be around 6% lower than 2024 due to rising tariffs on European goods, reducing demand for European exports. Terminal congestion will continue to affect certain European ports.

The end of summer holidays has helped ease labour shortages, improving port and service operations. Meanwhile, USTR service fees on Chinese-operated vessels will take effect 14 October; carriers such as China Ocean Delivery Company (COSCO) and Orient Overseas Container Line (OOCL) are retaining their ships in the trade, while others are reallocating affected vessels elsewhere. At the same time, the Shanghai Containerised Freight Index (SCFI) shows rates trending downward, with spot levels steady and space generally open as supply and demand show signs of stabilising.

Regional highlights

Europe to North America

Forecast: October demand is expected to remain stable but below typical levels, with volumes projected to decline about 6% compared to 2024, largely due to tariff impacts. No capacity constraints are anticipated in Trans-Atlantic westbound lanes with space readily available. Rates should remain stable with continued downward pressure.

Market dynamics: The new EU-U.S. trade agreement, which imposes tariffs of 15% on general exports and 50% on steel and aluminium, is reshaping demand patterns and driving volume reductions. Terminal congestion at Hamburg and Rotterdam is causing delays of up to five days, compounded by bottlenecks in hinterland connections—the inland rail, barge and truck networks that link ports to surrounding regions—creating additional delays. The combination of stable but softer demand and ample capacity creates favourable conditions for consistent service availability. Schedule reliability has improved month over month, with the Gemini Alliance remaining the only carrier group achieving reliability above 70%.

Key takeaways

European shippers should prepare for reduced demand due to new tariff implementations affecting pharmaceuticals, automotive goods and steel and aluminium exports to the United States. Companies can take advantage of stable rate conditions and ample capacity available for Trans-Atlantic deliveries. Shippers should monitor port-specific congestion updates and consider alternative routeing through less congested gateways when timing is critical. The improved labour situation following summer holidays should support more consistent operations through Q4.

South Asia, Middle East, Africa (SAMA)

Global trends

The South Asia, Middle East and Africa (SAMA) region is entering Q4 with open capacity across major lanes. U.S. tariff implementations are reshaping cargo flows, particularly for Indian exports and prompting exporters to explore new markets. Excess vessel capacity is pushing rates downward, creating cost advantages for shippers, while equipment availability remains strong at both major ports and inland container depots.

Regional highlights

India to North America

Forecast: The India to U.S. lane faces significant disruption, with booking volumes for key commodities declining nearly 30% compared to previous months. Vessels are currently sailing at 80-85% capacity. Rates from south India to USEC have declined sharply.

Market dynamics: U.S. tariffs of 50% on Indian goods are affecting textiles, automotive parts and lower-value cargo sectors. Carpet exporters face particular challenges as their competitors—China, Türkiye and Pakistan—continue to benefit from lower U.S. tariff rates, putting Indian products at a significant price disadvantage.

Carriers have withdrawn high season surcharges (PSS) and are adding extra port calls—such as Charleston on the Compagnie Maritime d’Affrètement (CMA CGM) Indamex service—to help offset lower booking volumes. Some Indian exporters are establishing operations in Middle East countries as an alternative to direct India-U.S. routeing due to current tariff levels.

India to Europe

Forecast: Volumes from ISC to north Europe will remain stable through the fourth quarter, with open space and declining rate levels.

Market dynamics: Carriers are maintaining regular service schedules with strong equipment availability at both major ports and inland container depots. Excess capacity is keeping rates competitive and creating favourable conditions for shippers, though heavy 20-feet dry containers continue to command premium pricing over 40-feet containers because of vessel tonnage restrictions.

India to South America

Forecast: South America lanes offer consistent rates and open space as Indian exporters seek alternatives to U.S. markets.

Market dynamics: Mexico, Peru and Chile represent growing opportunities as India diversifies export destinations beyond traditional U.S. markets due to tariff challenges. These South America lanes present opportunities for volume-based monthly agreements and competitive pricing as carriers seek to build cargo flows on routes that have seen increased demand. Brazil deliveries also offer similar opportunities as carriers work to develop these alternative trade corridors.

Key takeaways

Exporters in the SAMA region should secure capacity early on Europe lanes to capture competitive rates while market conditions remain favourable. Companies affected by U.S. tariffs should consider accelerating deliveries before additional restrictions take effect. Those planning operations in the Middle East should account for lead times when establishing new routeing capabilities, while careful attention to equipment positioning and documentation requirements is necessary to avoid delays.

South America

Global trends

South American ocean freight markets are expected to face operational challenges through the fourth quarter. The South America West Coast (SAWC) will continue to experience weather-related disruptions, with blank sailings likely to persist, particularly in the southern regions. Seasonal fruit exports from Peru and Chile will tighten capacity as volumes rise during Q4. Pacific Coast terminals will continue to encounter constraints from ongoing infrastructure projects, while Atlantic operations show signs of improvement with enhanced service options. Terminal congestion remains a concern at key gateways, as some facilities are still recovering from recent backlogues.

Regional highlights

South America to North America

Forecast: SAWC rates are expected to stay stable or decline slightly, while Brazil rates should hold steady despite tariff-related volume decreases. West Coast routes will face continued operational challenges and capacity constraints, while Atlantic Coast services show improvement with new carrier options becoming available.

Market dynamics: Weather conditions are creating operational disruptions across SAWC, with severe weather forcing carriers to implement emergency departures without completing full port rotations. This leads to blank sailings and service interruptions, particularly affecting southern regions like Chile. These weather-related disruptions make ports unsafe or inaccessible for vessels, forcing them to skip planned port calls, which creates unpredictable schedules and prompts carriers to cancel entire sailings rather than operate severely delayed voyages.

Peru and Chile's fruit export season in Q4 will generate large cargo volumes that will strain available delivery capacity, making space more difficult to secure for all exporters. Congestion will affect loading and transshipment operations in key ports including Cartagena, Colombia, even though Cartagena terminal has recently seen improvements in operational efficiency. The port is proving to be a more reliable alternative for cargo to the United States, Brazil and Europe compared to Buenaventura. Open delivery capacity in Brazil reflects reduced export volumes of wood, tiles and coffee due to tariff impacts.

Key takeaways

South American exporters should consider routeing alternatives during Q4, particularly for time-sensitive cargo. Cartagena offers improved reliability compared to Pacific Coast alternatives for deliveries to North America, Brazil and Europe. Companies delivering from Peru and Chile should plan for tight capacity conditions during fruit season and secure space early. Shippers using Buenaventura should factor in additional transit time due to ongoing operational challenges from infrastructure work. Atlantic Coast lanes provide more stable service options compared to weather-affected Pacific Coast operations.

Oceania

Global trends

Oceania export markets are holding strong heading into the final quarter of 2025. Several key commodity sectors will shape capacity and rate dynamics through early 2026. The agricultural export cycle is creating distinct regional patterns, with strong pulse exports (legumes such as chickpeas and lentils) from Queensland and New South Wales shifting south to Victoria and South Australia during the fourth quarter.

Cotton volumes remain solid and continue to support capacity across multiple lanes. Hay exports are entering high season, strengthening overall export volumes. New Zealand's kiwi season has concluded, freeing up significant capacity for other cargo in the fourth quarter and creating opportunities for shippers across various commodity sectors.

Regional highlights

Oceania to Asia

Forecast: Demand for wool, hay and dairy will keep volumes elevated through the fourth quarter, though rates are expected to remain under pressure due to competitive market conditions.

Market dynamics: Chinese demand for agricultural products—from livestock feed to dairy—remains strong, providing a reliable baseline for deliveries. However, freight rates are under downward pressure as exporters compete for business and buyers remain cost-conscious, often negotiating to secure the best available rates. The result is steady demand with softer delivery rates, reflecting the balance between strong import needs and a competitive, price-sensitive market.

Oceania to North America

Forecast: Tight capacity through the fourth quarter is likely to keep rates steady, despite ongoing market pressures. USWC capacity constraints for dry cargo have recently eased, though refrigerated cargo will remain constrained through late October. USEC routes continue to be more readily available.

Market dynamics: With New Zealand’s kiwi season recently concluded, significant delivery capacity has opened up for other commodities. However, much of this space is expected to be quickly taken by traditional exports such as beef, lamb and dairy. This creates a short window of opportunity for other deliveries before the usual commodity flows fill the available slots.

Oceania to Europe

Forecast: Space availability is expected to remain favourable for both dry and refrigerated cargo throughout Q4, providing exporters with scheduling flexibility.

Market dynamics: European importers source fewer agricultural commodities from Oceania compared to major markets like Asia and North America, where demand for Australian and New Zealand products like wool, dairy and beef is much stronger. This lower European demand means less competition for vessel space and more predictable service schedules on Oceania to Europe lanes. As a result, Australian and New Zealand exporters face fewer capacity constraints and can secure more reliable booking options, particularly benefiting companies that can plan deliveries around less congested sailing schedules rather than competing for limited space during peak export periods to busier destinations.

Oceania to northeast Asia

Forecast: Services will remain open for dry cargo through Q4, though refrigerated cargo requires advanced planning.

Market dynamics: Northeast Asia maintains consistent import demand for Australian agricultural products and raw materials, supporting regular delivery schedules and reliable service availability for standard dry cargo deliveries. However, refrigerated cargo operates under different constraints due to the specialised refrigeration equipment required on vessels and the higher operational costs of maintaining temperature controlled conditions throughout the voyage.

This creates a two-tier capacity system where dry cargo benefits from standard vessel space allocation, while refrigerated deliveries compete for limited temperature controlled slots that require advanced co-ordination with carriers. The strong demand for temperature controlled products like fresh produce and dairy from Australia means these specialised spaces fill up quickly, requiring exporters to book earlier and secure reliable refrigerated capacity.

Oceania to Southeast Asia/ISC

Forecast: Services will remain generally open through Q4, with minor capacity constraints during peak periods.

Market dynamics: Oceania to ISC and Southeast Asia lanes benefit from relatively balanced supply and demand compared to the more active North America and China trade lanes. While most delivery services maintain consistent availability, some dry cargo services face temporary capacity limitations through mid-October due to seasonal delivery patterns and equipment repositioning.

The lower cargo volumes on these lanes compared to major destinations like China and the United States mean that Australian and New Zealand exporters typically have more booking options and face less competition for vessel space. This creates more predictable service schedules and greater flexibility for exporters that can adapt delivering timing to take advantage of available capacity windows.

Key takeaways

Oceania exporters should secure early bookings for North America lanes, where capacity remains tight, though USEC services are generally more accessible than the USWC. Companies with flexible timing can take advantage of the capacity freed up by the recently concluded kiwi season in New Zealand, but this opportunity is short-lived, as traditional exports are expected to fill the available space quickly. European lanes continue to offer the most scheduling flexibility, while refrigerated cargo to northeast Asia requires earlier co-ordination to secure space.

Download slides

Download slides